2018 Business Solar Tax Credit

You calculate the credit on the form and then enter the result on your 1040.

2018 business solar tax credit. If you install solar panels before the end of 2020 you will receive a tax credit that is equal to 26 percent of the cost of your solar installation. As of 2018 section 179d expired at the end of 2016 meaning that your building modifications must have been done before december of. The equipment uses solar energy tax credits for business could be greater than regular renewable tax credits to generate electricity heat or cool a building provide hot water or solar process heat. 95 618 which created a temporary 10 tax credit for business energy property and equipment using energy resources other than oil or natural gas.

The energy tax credit was first enacted in the energy tax act of 1978 p l. To claim the credit you must file irs form 5695 as part of your tax return. Economy in the. If you end up with a bigger credit than you have income tax due a 3 000 credit on a 2 500 tax bill for instance you can t use the credit to get money back from the irs.

Tax credits for solar and wind energy property were refundable credits. The federal solar tax credit also known as the solar investment tax credit or itc is the single most important solar incentive available in the united states. Your general business credit for the year consists of your carryforward of business credits from prior years plus the total of your current year business credits. When you install a solar system 26 of your total project costs including equipment permitting and installation can be claimed as a credit on your federal tax return.

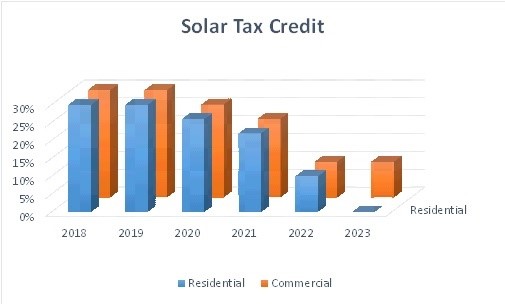

The credit for solar illumination and solar. The protecting americans from tax hikes act of 2015 has implemented the phasing out of the investment credit for solar illumination and solar energy property. An important part of the tax credits available to businesses for energy saving is the solar investment tax credit. The solar investment tax credit.

Filing requirements for solar credits. If you spend 10 000 on your system you owe 2 600 less in taxes the following year. You subtract this credit directly from your tax. In addition your general business credit for the current year may be increased later by the carryback of business credits from later years.

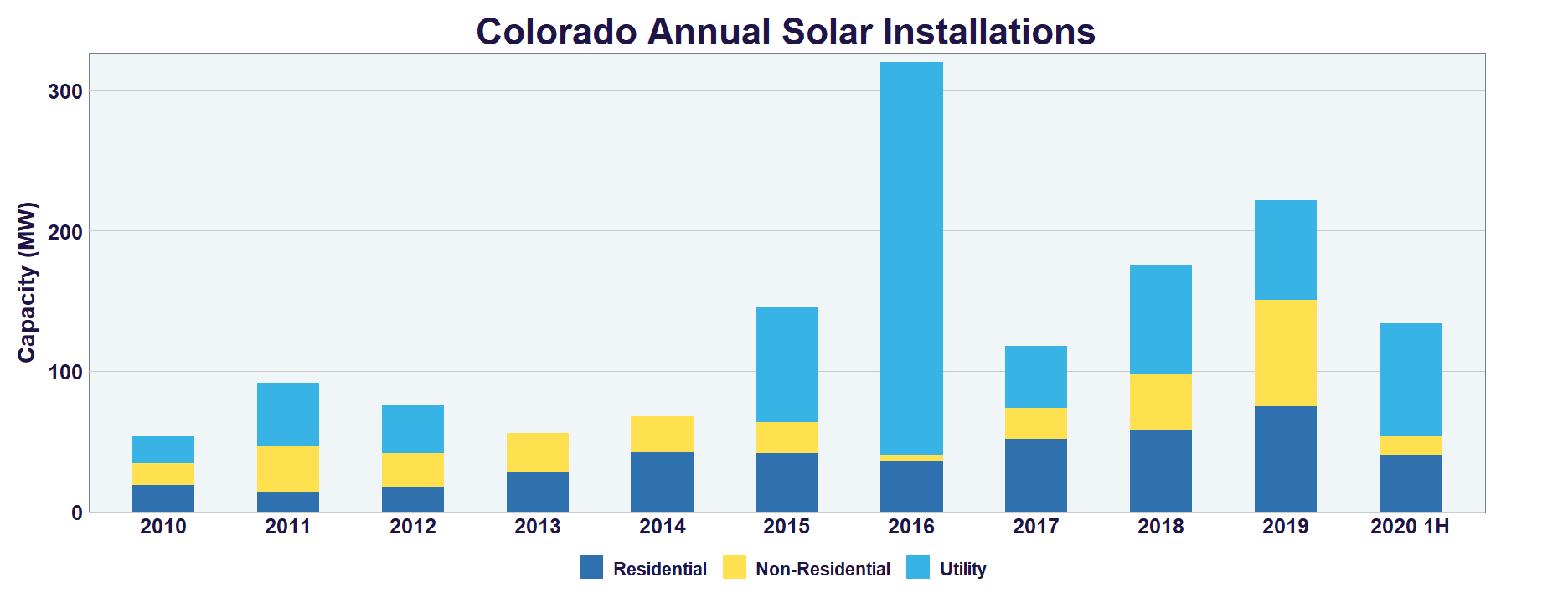

The solar tax credit expires in 2022. Solar industry has grown by more than 10 000 creating hundreds of thousands of jobs and investing billions of dollars in the u s. The solar investment tax credit itc is one of the most important federal policy mechanisms to support the growth of solar energy in the united states. 2018 before the grant was made.

Since the itc was enacted in 2006 the u s. 25d a also provides credits for fuel cell wind energy and geothermal property but this article is focused on solar energy a qualified solar electric property expenditure qsepe means an expenditure for property which uses solar energy to generate electricity for use in a dwelling unit located in the united states and used as a.