2018 Hawaii Solar Tax Credit

25 tax credit for research activities attach form n 346.

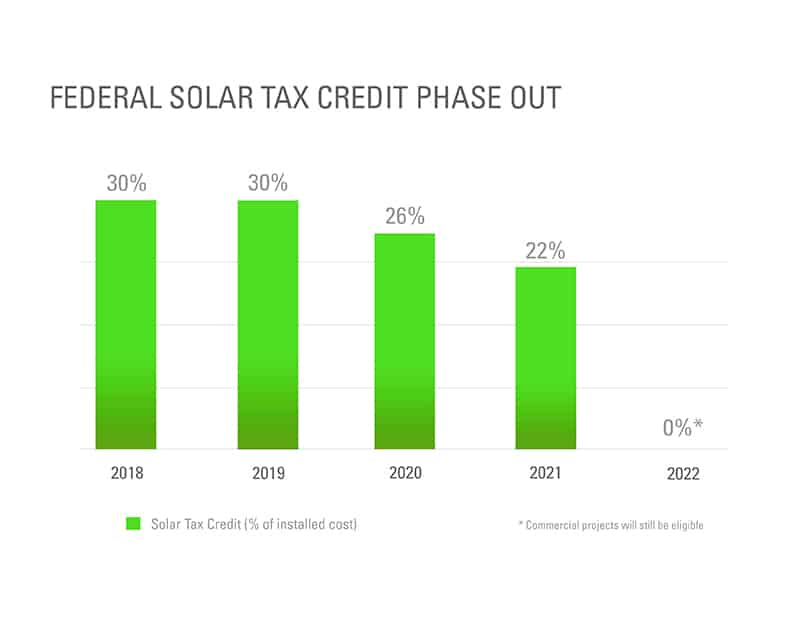

2018 hawaii solar tax credit. Wind facilities commencing construction by december 31 2019 can qualify for this credit the value of the credit steps down in 2017 2018 and 2019. Adding another 4 5 kw of solar panels should eliminate most of the rest of your 190 monthly bills and cost somewhere around 12 000 15 000 before the 26 federal tax credit and hawaii s own 35 tax credit. The same personal tax credit of 35 of the actual cost of the system or 2 250 whichever is less applies to solar attic fans in hawaii as well as solar hot water. You put the cash up front and then write off that amount the next time you file your taxes.

Tens of thousands of solar water heaters. Industrial use including air conditioning 170 350 f. Or electricity generation 350 2000 f. 2012 01 pdf temporary administrative rules relating to the renewable energy technologies income tax credit retitc.

Schedule cr rev 2018 schedule of tax credits author. Renewable energy technologies income tax credit hawaii s renewable energy technologies income tax credit 3 can cover about 5 000 of your solar installation costs depending on the total cost of your system. These credits work the same as any tax credit. Solar thermal solar thermal systems including solar water heaters use the sun s energy to heat water for residential use up to 160 f.

Energy from the sun solar energy is used in two different types of solar energy systems. See below for more information. The hawaii solar tax credit allows homeowners to save up to 35 of the total cost of installing a solar pv system. 2 renewable energy production tax credit ptc summary.

State of hawaii department of taxation subject. Retitc forms shortcut to form n 342 and instructions form n 342a form n 342b and instructions and form n 342c and instructions. The credit is applied the same year when the system is installed and it is limited to 5 000 per system per year. Since a pv system is defined as 5 kw installing a more powerful system would mean you d have 2 systems installed.

Local solar attic fan incentives. Tax credits do a lot to make solar affordable and hawaii is no exception to states offering large and lucrative tax credits for putting solar panels on your roof. The itc applies to both. Solar wind renewable energy technologies income tax credit for systems installed and placed in service on or.

One of the best incentives that comes along with a solar energy system is the solar investment tax credit itc which allows individuals who purchase a solar system to deduct 30 percent of the cost of the system from their federal taxes. If you re able to claim both tax credits you could be looking at a net year 1 cost of 5 265 to wipe out your 2 300 annual bills. Tax information release no. The state of hawaii also offers at 50 75 rebate for solar attic fans via local utility companies.

While you can receive this amount as a tax credit you can also choose to receive a slightly reduced amount as a tax refund.