2018 Iowa Solar Tax Credit

Applications are due may 1st 2020 for installations completed by december 31 2019 solar energy system tax credits the application for the tax credit is available online within the tax credit award claim transfer administration system cactas.

2018 iowa solar tax credit. Enter the total of other credits from part ii of the ia 148 tax credits schedule. Iowa residential solar tax credit when it comes to clear cut state solar incentives it doesn t get a lot simpler than the ma renewable income offer. This credit was established to partially offset the school tax burden borne by agricultural real estate current law allows a credit for any general school fund tax in excess of 5 40 per 1 000 of assessed value. Qualifying installations must meet the criteria for the federal energy efficient property credit related to solar energy provided in sections 48 a 3 a i and 48 a 3 a ii of the.

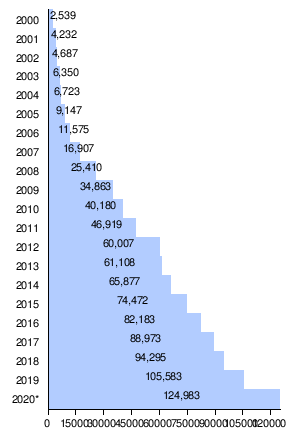

Since then it s provided a total of 21 6 million in incentives for nearly 4 000 projects. All land used for agricultural or horticultural purposes in tracts of 10 acres or more and land of less than 10 acres if contiguous to qualifying land of 10. The iowa tax credit for residential installations cannot exceed 5 000. An application for the iowa credit for businesses cannot be made until the installation of the solar system is complete and the system is placed in service.

Adoption tax credit an adoption tax credit is available for individual income tax equal to the first 5 000 of unreimbursed expenses related to an adoption per each child placed in iowa. Solar energy system tax credit tax credit transfers 9 16 2020 9 09 pm. Solar energy system tax credit. The iowa legislature created the 15 percent tax credit in 2012.

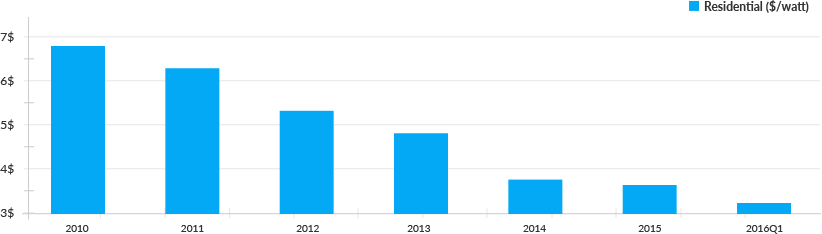

Iowa is the only state in the midwest and one of just a dozen nationally that still offers a state solar tax credit. The federal credit and thus the iowa tax credit is available for property placed in service before january 1 2022. The most significant incentive to install solar panels for homes and businesses is the federal solar tax credit at the end of 2020 the amount of the credit will decrease from 26 to 22 of the cost of the solar installation. There is no limit on the amount of income earned by an individual to be eligible for the credit.

Taxpayers who claim this tax credit are not eligible to claim a renewable energy tax credit under iowa code chapter 476c for the production of solar electricity. The system is designed so that once you have submitted an application you can later sign into the system to track its status. Solar incentives rebates and tax credits available in iowa in 2020.