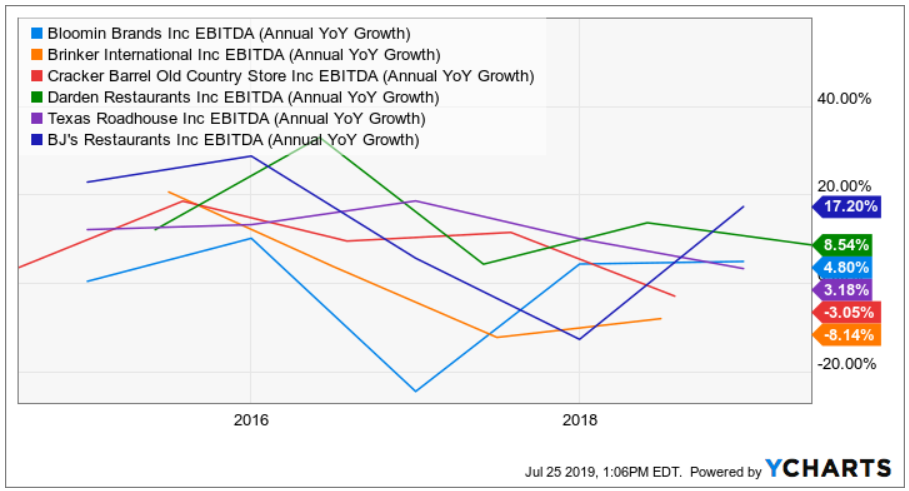

4 Wall Ebitda

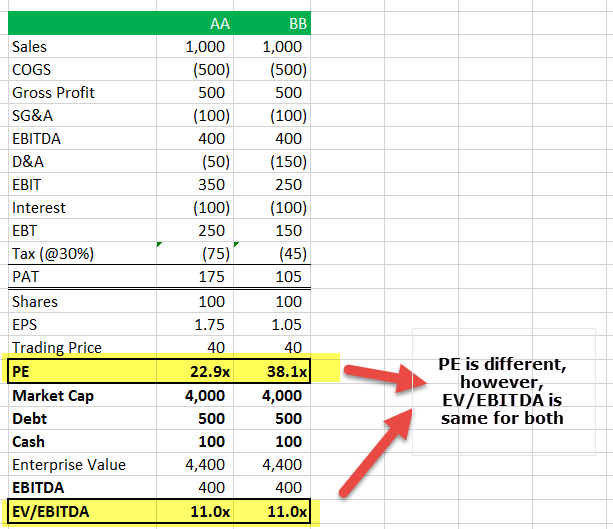

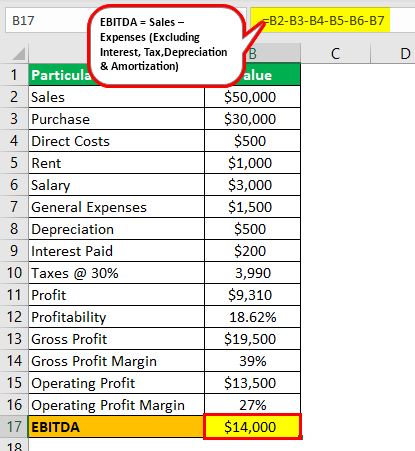

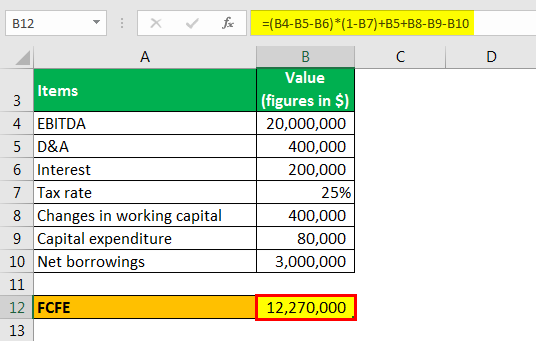

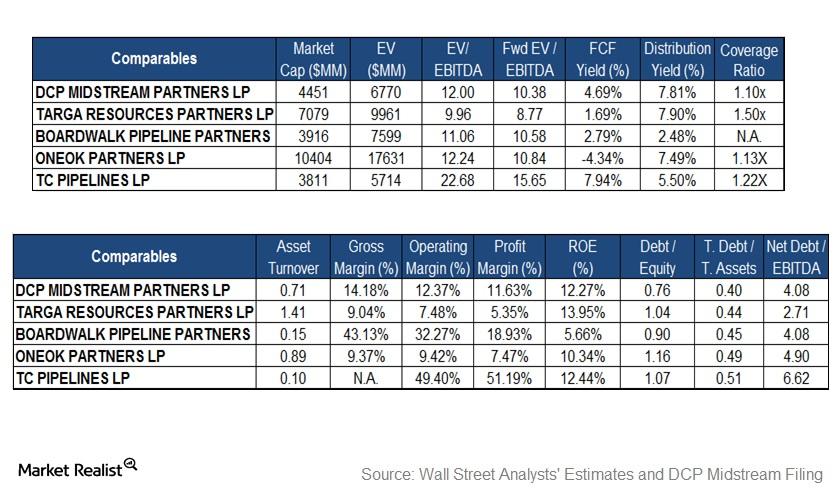

Adding back the overall expenditures due to amortization and depreciation to the firm s ebit.

4 wall ebitda. What does 4 wall ebitda mean. Il mesure la rentabilité brute du cycle d exploitation de l entreprise son cash flow indépendamment des événements extérieurs de sa politique d investissement ou de financement. Not use field ebitda but rather. Ciao elena scusa hai ragione tu non avevo letto bene la tua domanda.

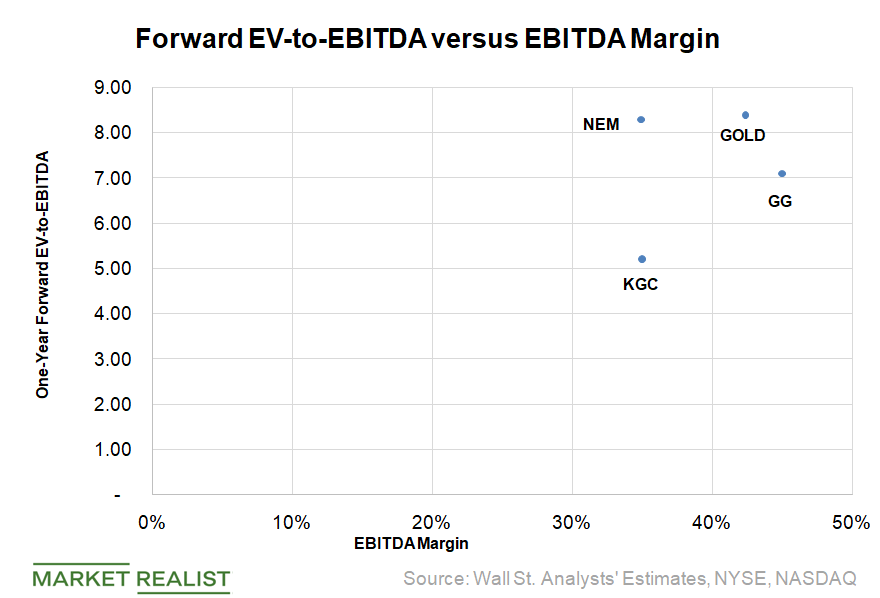

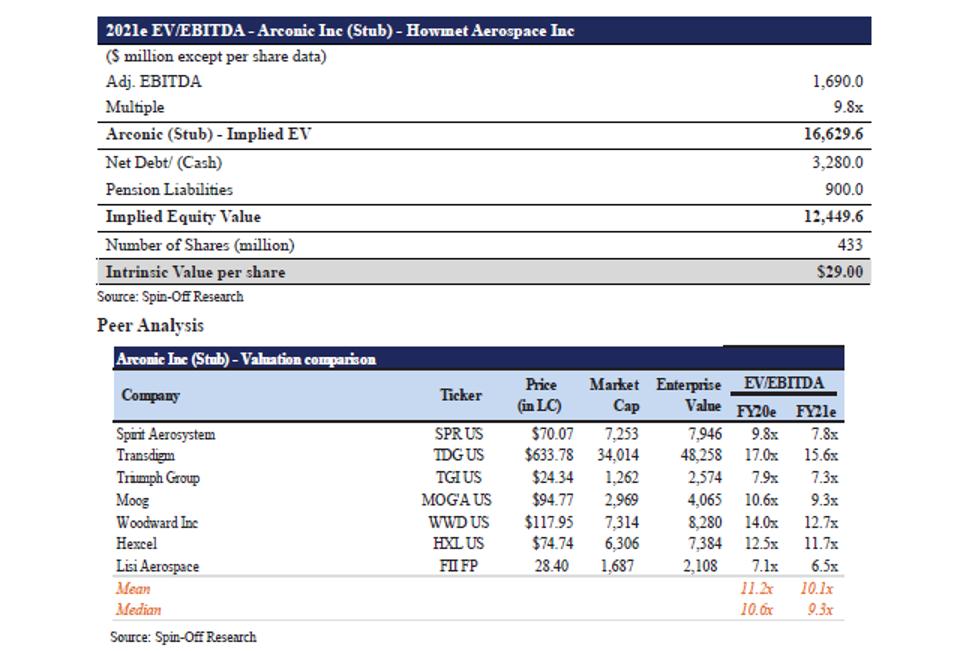

The ebitda within the 4 walls of that store as opposed to the company s ebitda as a whole grazie a tutti in anticipo. Non ho trovato niente in italiano come 4 wall quindi io lo tradurrei come punto vendita filiale a seconda. The ebitda within the 4 walls of that store as opposed to the company s ebitda as a whole. A lower ratio is a sign that a company is undervalued.

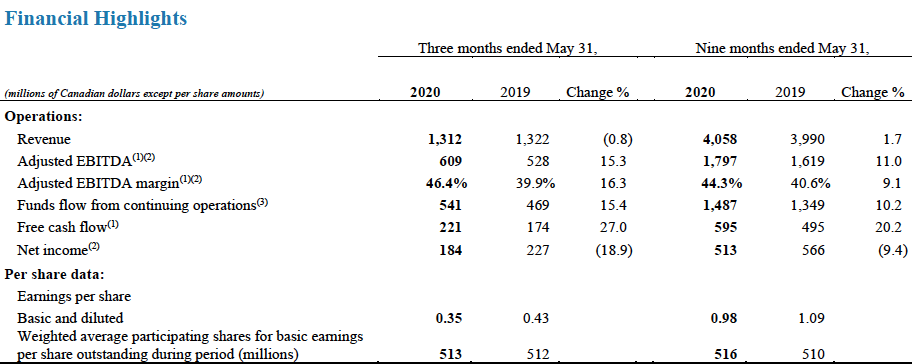

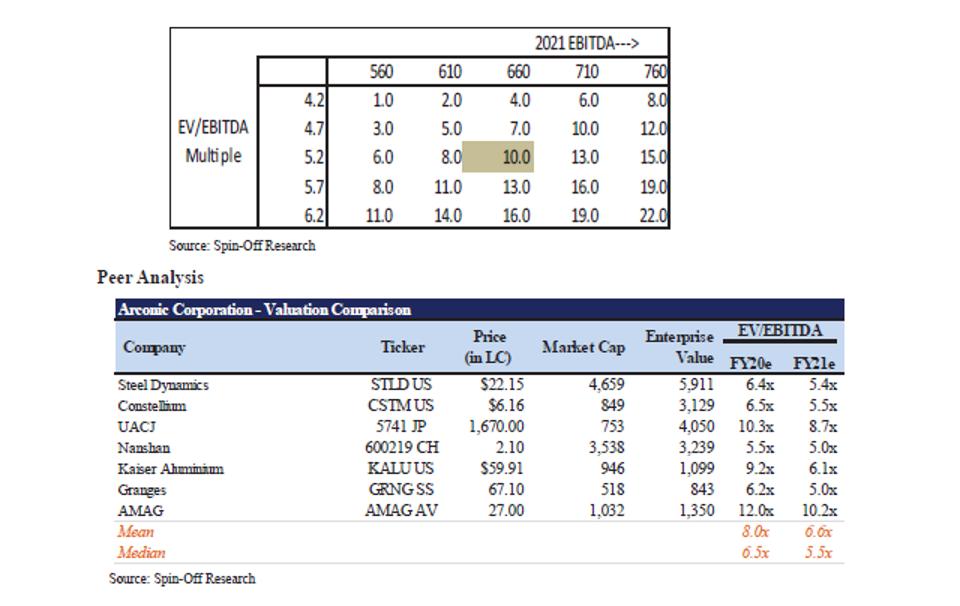

L ebitda est un solde intermédiaire de gestion créé aux états unis et usuellement calculé dans la comptabilité des entreprises américaines. Private companies usually have an ebitda multiple of around 4x. Public companies usually have a higher ebitda multiple averaging around 8x. Thus amortization expense 2 000 5 years 4 00 year.

This is a bankruptcy term mainly used to select the stores that need their leases cancelled. Monday january 31 2011 volume 22 issue 20. However some franchisees have reported higher profit margins particularly those online download. The ebitda of a particular store unit.

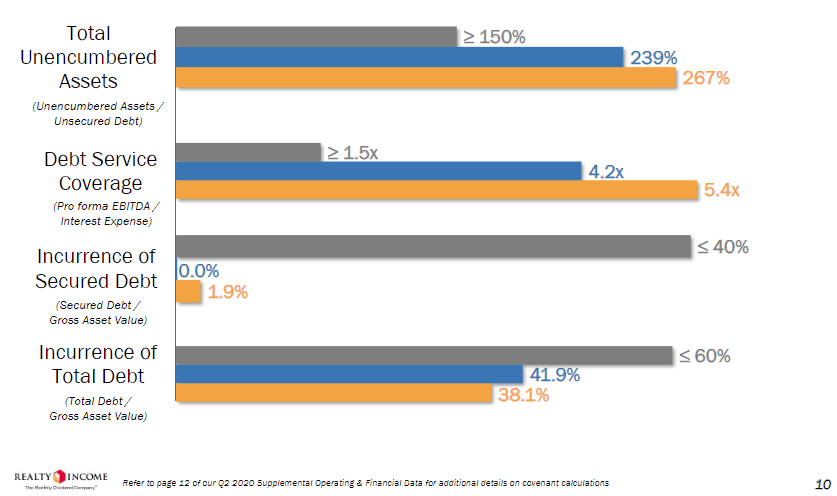

4 wall ebitda margin before 5 royalty 41 1 4 wall ebitda margin after 5 royalty 36 1 unlevered cash on cash return 25 2 appealing unit economics 1 based on corporate store ebitda margins. Now calculating ebitda using the formula ebitda ebit amortization depreciation. How does this differ from regular ebitda. As amortization and depreciation were.

Ebitda is defined as the calculation of net earnings prior to amortization depreciation taxes and interest.